In This Article:

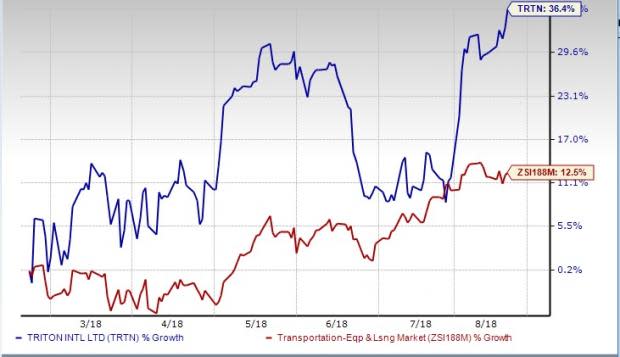

Shares of Triton International Limited TRTN have rallied 36.4% in the past six months, handily outperforming its industry’s 12.5% growth.

Let’s delve deep to unearth the reasons behind the company’s impressive price performance and examine if there is scope for further upside.

Triton International has a solid earnings surprise history, having reported better-than-expected earnings per share in each of the trailing four quarters. The most recent earnings beat came in the second quarter of 2018, results of which were announced last month.

This Hamilton, Bermuda-based shipping container leasing company’s earnings and revenues also improved year over year in the second quarter Higher revenues from operating leases in addition to a lower effective tax rate aided results.

Also, the company's efforts to reward its shareholders through dividend payments are encouraging. In May 2018, Triton International hiked its quarterly cash dividend by 7 cents to 52 cents per share. In the first quarter of 2018, the company paid approximately $36 million in dividends, reflecting an increase of 8.5% year over year.

Apart from Triton International, other transportation companies like Union Pacific Corporation UNP, Norfolk Southern Corporation NSC and Southwest Airlines Co. LUV have raised their respective dividend payouts this year. Huge savings owing to the Tax Cuts and Jobs Act led to the dividend hike.

With a low effective tax rate, companies are now left with huge savings to augment their free cash flow. This surge in free cash flow is enabling them to engage in such shareholder-friendly activities.

Triton International’s outlook for the rest of 2018 is impressive as well. It expects gradual increase in adjusted net income for the current year. Meanwhile, demand for Triton International’s containers is anticipated to remain strong, thereby driving growth. Favorable market conditions should also boost results in the remaining quarters of 2018.

At its Investor Day on May 31, the company stated that it expects the bottom line to grow moderately in the remainder of the year. Asset growth for 2018 is projected between 7% and 10%. Cash flow before capex is anticipated to exceed 80% of leasing revenues.

A Broker Favorite

Triton International’searnings estimates reflect a healthy uptrend. Evidently, the Zacks Consensus Estimate for current-year earnings moved north 3.3% in the last 60 days.

Given the wealth of information at the disposal of brokers, it is in the best interests of investors to be guided by broker advice and the direction of their estimate revisions. This is because the direction of estimate revisions serves as an important pointer when it comes to the price of a stock.