In This Article:

It has been about a month since the last earnings report for Conagra Brands Inc. CAG. Shares have added about 2.8% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is CAG due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Third-Quarter Fiscal 2018 Results

Conagra reported mixed results for third-quarter fiscal 2018 (February 2018).

Earnings

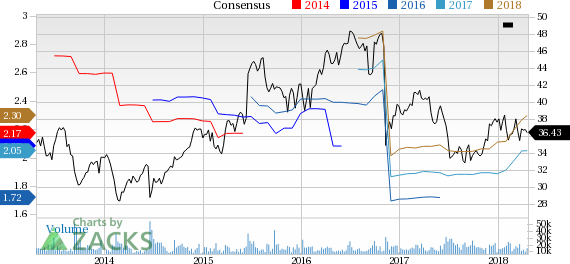

In the fiscal third quarter, Conagra’s quarterly adjusted earnings from continuing operations were 61 cents, surpassing the Zacks Consensus Estimate of 56 cents. Also, the bottom line was 27.1% higher than the year-ago tally.

Revenues

Conagra generated net revenues of $1,994.5 million in the reported quarter, missing the Zacks Consensus Estimate of $2,010 million. However, the top line marginally exceeded the year-ago tally by 0.7%.

Segmental Details

Grocery & Snacks: The segment’s quarterly sales were $838.3 million, down 1.3% year over year.

Refrigerated & Frozen: Quarterly revenues were up 3.2% year over year to $688.5 million.

International: Sales of the segment were $223.4 million, up 8.9% year over year.

Foodservice: The segment’s quarterly revenues totaled $244.3 million, down 6% year over year.

Other Financial Fundamentals

Conagra’s cost of goods sold was up 2.6% year over year to $1,395.7 million. Adjusted gross profit contracted 160 basis points (bps) to 30% during the reported quarter.

Selling, general and administrative (SG&A) expenses dropped 5.6% year over year to $330.2 million. Interest expenses dipped 12.7% to $39.8 million due to lower debt levels.

Conagra exited the fiscal third quarter with cash and cash equivalents of $132.9 million, lower than $251.4 million recorded at the end of fiscal 2017. Senior long-term debt (excluding current portion) was $3,037 million, up from $2,573.3 million reported as of May 28, 2017.

In the nine-month period ended fiscal 2018, Conagra generated net cash of $842.3 million from operating activities, slightly down from $846.5 million reported in the year-earlier period. Capital spent on additions of property, plant and equipment totaled $175.9 million, up 11% year over year.

During the fiscal third quarter, Conagra repurchased nearly 8 million common stock for $280 million.

Outlook

Conagra intends to enhance its near-term profitability on the back of stronger top-line performance. It believes new merchandising, distribution and consumer trail-related investments will bolster the sales of its major brands. However, input cost inflation and flaring up transportation expenses are expected to drag down margins in the upcoming quarters.

The company anticipates reporting adjusted earnings to be $2.03-$2.05 per share for fiscal 2018, higher than the previously-stated range of $1.84-$1.89 per share. Moreover, Conagra expects to buy back common stock worth $1.1 billion in the fiscal.